FastHedge Investment. Grow Fast. Hedge losses.

"The stock market is a device to transfer money from the impatient to the patient."

—- Warren Buffett

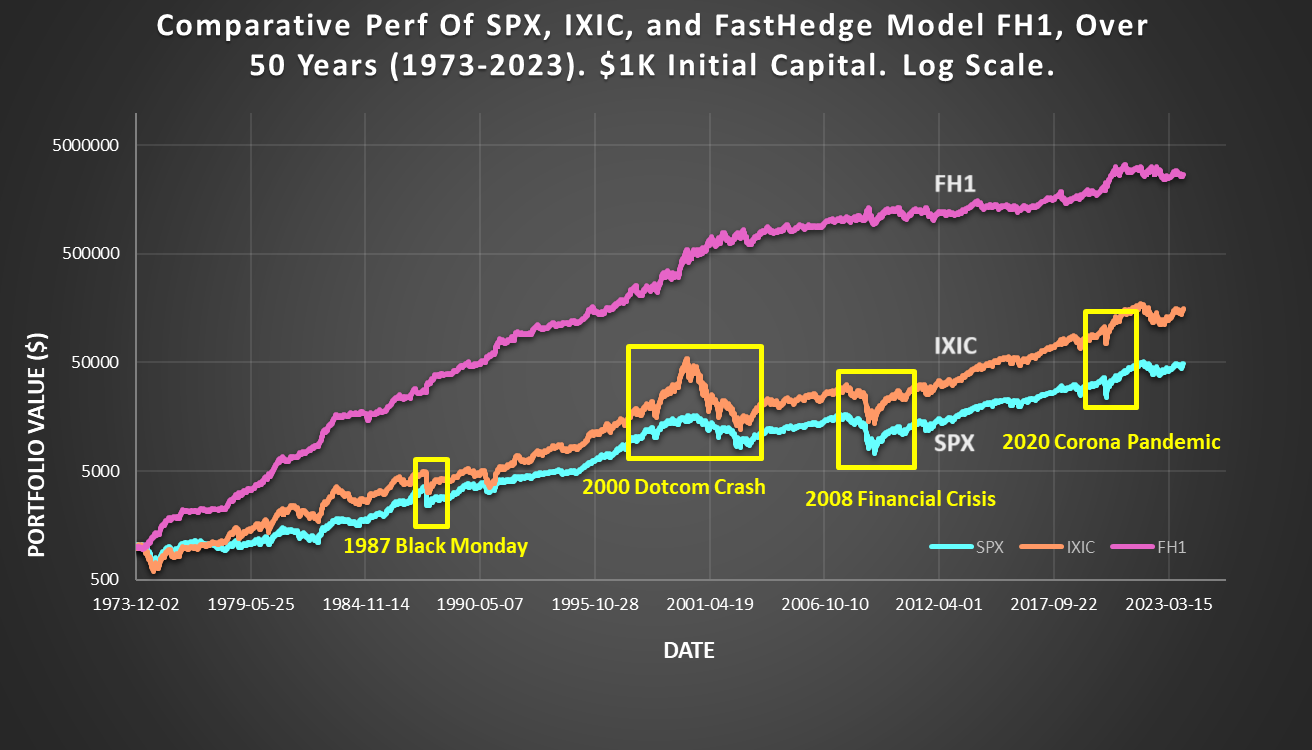

For most investors, investment should be a long game, to grow wealth over a lifetime. It takes patience. Yet for decades, small investors have gotten on average a 5% annual return -- well below the S&P500 (SPX). Meanwhile, 94% of all managed funds also underperform the market. And markets can fall deep: 57% for SPX in 2008, 78% for Nasdaq (IXIC) in 2000. It can be devastating. But with a little help, even the small investor can get strong returns over time. When markets are up, we grow fast by leveraging; when they are down, we hedge against losses. Our 50-yr. test shows dramatic gains over the market, effortlessly; see figure below. Even with FastHedge Model 1 (FH1), our simplest. Note that this figure is in log scale. For a linear scale view, where the true magnitude of our gains becomes more apparent, see the Research page.

Welcome to the FastHedge approach. This is a private placement, limited to accredited investors; please see the Subscribe page.

Start by reviewing the free brochure, which has valuable insights here.